Comments By Bush Country

- Bush Country

- Joined:

- 8 years, 2 months ago

- Comments:

- 69

Posted: 1 year, 1 month ago

View Topic:

I was in Schofield last night and in Plymouth today. Are you still hanging around up here?

Nalee, I delivered a load yesterday to Cargill in Butler, WI. I bet you’ve been there. While there I met another ASL driver and had a brief conversation. He told me his name but I already have forgotten. Small world. (Don’t take that personally, lol)

No, it was too cold in WI. I headed south after picking up another load and am almost to Memphis for my 10 hr. break. Deliver in Cleburne, TX tomorrow.

Cleburne, Texas - my home town. Always surprised to see it come up in the news.... or in a trucking forum.

Posted: 1 year, 1 month ago

View Topic:

Hello everyone. looking for good sunglasses and updates.

Thank you for all the replies. I will order a pair of the 3m safety glasses and try them. if that don't work, I will keep trying others that you people suggested.

I have bought them at both Lowe's and Home Depot. Sometimes 3M, sometimes Dewalt, depending on what's in stock.

Posted: 1 year, 1 month ago

View Topic:

I’m a newbie, looking for a career change.

If you poke around enough. There are a few companies that offer CDL instruction and training without a contract. As with anything, there is a give and take with it.

You should really stay with your first company at least a year even if you're not contracted to. As was said, we're in a recession and freight volume is low right now. Companies may be a bit more tight on hiring right now.

Davy - we didn't sign a contract with Knight. We signed a promissory note that is payed back to them over the course of a year. One could go there for the school without a commitment to Knight, as one of my classmates did. We also had one guy in our Top Gun class that got his CDL elsewhere.

Posted: 1 year, 1 month ago

View Topic:

I may have to make a choice.....

NaeNae,

My mom passed away from dementia in 2021 at age 92. I got the call from hospice that she was "actively passing" as I was driving home from Knight's Top Gun in Phoenix. This was on a Friday. They said she had been actively passing since that Monday. I asked them how long she had and they said less than 72 hours. I got home Saturday morning and went to see her that afternoon. I planned to go back on Sunday afternoon and got the call that she had passed about 30 minutes before I was going to go see her.

The point of this story is that if your mom is in hospice care, they should be able to tell the difference between her general decline and actively passing. If you wanted to stay on the road but make it to her before the end ask hospice about this and request that they call you as soon as she is actively passing, and ask for a time frame.

As for if you "should" be there - only you can answer that, and you have to answer to no one for your decision.

Posted: 1 year, 2 months ago

View Topic:

What is the deal with 1099 trucking jobs? Is there a catch?

I work as a 1099 contractor (consultant) in the oilfield. The tax implications discussed below should be similar for any business.

As to how this applies to trucking – for 1099 to be worthwhile I think one would have to be paid at a considerably higher rate (I’m thinking 2x to 3x higher) than a company driver. That doesn’t take into consideration the other issues involved as pointed out by Old School, Delco Dave, PackRat, and Zen joker.

I bill the oil companies through a consulting company that takes 10% of my day rate and provides liability insurance and workman’s comp, as well as paying me the same week that I invoice instead of me having to wait for the oil company to pay. Since my wife is employed, we have health, dental, and vision insurance through her employer. If I needed to get my own health insurance the BCBS plans available through the consulting firm range from $900 to $1,550 per month for me only. Those are the rates for age 64+. For a 21 year old the rates are from $300 to $500 per month and increase based on age.

For me, there were three ways to set up a business as a contractor: sole proprietor, LLC, and S-Corporation. Each one has its own tax implications. When I first started I ran as a sole proprietor for a few months before getting my S corp set up.

A sole proprietor is responsible for the Self-Employment tax (Social Security), Medicare, and income tax on every penny earned. SS tax is 12.4% and Medicare is 2.9%. Income tax can be estimated based on what one expects to earn. So for starters, there’s 15.3% of gross taxed, not counting income tax. I live in Texas, so there’s no state income tax to consider.

I have not operated as an LLC, but my understanding is that any money earned by the LLC becomes taxable once it is withdrawn from the LLC, and is fully taxed like the sole proprietor example.

I operate as an S-Corporation. I have to pay myself a “reasonable” salary. Technically half of the SS tax is withheld from my salary and the other half paid by the S corp. Same for Medicare tax. I withhold 20% for income tax. The SS, Medicare, and income tax are paid monthly via form 941. I also pay a quarterly payment since my wife and I have other income from investments. My main expenses are vehicle expenses (gas, tires, oil changes, repairs) and FR clothing, all of which I pay for through the S corp. I also pay unemployment insurance. In 2022, mine was $0 for the state of Texas, and $42 to the feds since I’ve not filed any unemployment claims on myself.

The tax advantage of an S corp is that anything left over after my salary, taxes, and expenses are paid can be taken as a “distribution”, and is not taxed (by the Feds, states probably vary, but -0- for Texas). For 2022, as percentages:

Total 1099 gross receipts = 100% paid out as follows: Salary = 37%, Taxes = 11%, 401k match = 8%, Expenses = 2%, and Distributions = 42%.

The taxes were 30% of my salary.

Posted: 1 year, 3 months ago

View Topic:

Sorry this happened BK.

For newcomers reading this...

This has become a tricky little area for CDL drivers. Each time you get a new physical done you must self certify it with your state. I have found the two best ways in my state (TX), are to walk it into a DMV office and have them scan it into their system while I'm standing there with the clerk, or email it to the specific email address the state provides. I always follow up the email one week later with a phone call, verifying the new expiration date.

I never trust the state to handle important documents efficiently. I do take measures to hold them accountable.

OS - I scanned & emailed mine in Texas last year (5.24.22) and received an automated confirmation email back the same day. In the email there was a link to use to check eligibility which is still active today (1.5.23). Seems as though the system works well, based on a sample size of one.

Posted: 1 year, 4 months ago

View Topic:

Travis - you've started for SLB? Now you've joined me in the ranks of oilfield trash. How's it going?

Posted: 1 year, 5 months ago

View Topic:

Schlumberger Oilfield Concrete Driving

Travis -

Where is the job located?

Schlumberger, or as they are changing the name, “SLB” is the world’s largest oilfield service company. I’ve not worked for them, but I have worked for other service companies and been in the business for over 40 years.

The advantages I see for the job for a driver are – hourly pay, time off, and full benefits (health, dental, & vision insurance, 401k, etc). There’s also room for promotion – normally a bulk truck driver would move up to cement pump operator, and from that to cementer (service supervisor). For housing, they will probably put you up in a man camp – I’d ask about that to be sure. I’m surprised that SLB is paying for flights for operators, so get that in writing. You will travel on your time, which makes that 6 days off more like 4 depending on your travel schedule.

The hours for your two weeks on duty are long. You will be out in the weather no matter what it is. I work on the frac side, and the only thing we shut down for is lightning since we have so much electronic equipment on location. You will also eventually work every day of the year. Drilling rigs, which you will be delivering to, generally don’t shut down for holidays.

Other companies that should have positions like this are Halliburton, BJ Services, and Nextier. Plus there’s some smaller companies, but I’m not sure which of them are in the cementing side.

There are other driving jobs. Hauling frac sand, fuel delivery, rig moving (specialized trucks for this), hauling drill pipe & casing, and so on. I don’t recommend hauling sand – it’s done by a lot of small companies as third-party contractors, and I suspect that a lot of them are 1099 companies. Fuel delivery, on the other hand, I’ve had every driver I’ve asked say that it is the best driving job they’ve had.

Not to be pedantic, but it is cement, not concrete. Concrete has aggregate in it and is used in construction. Cement is what holds the aggregate together. Oil field cementing does not use aggregate.

Hopes this helps!

Posted: 1 year, 9 months ago

View Topic:

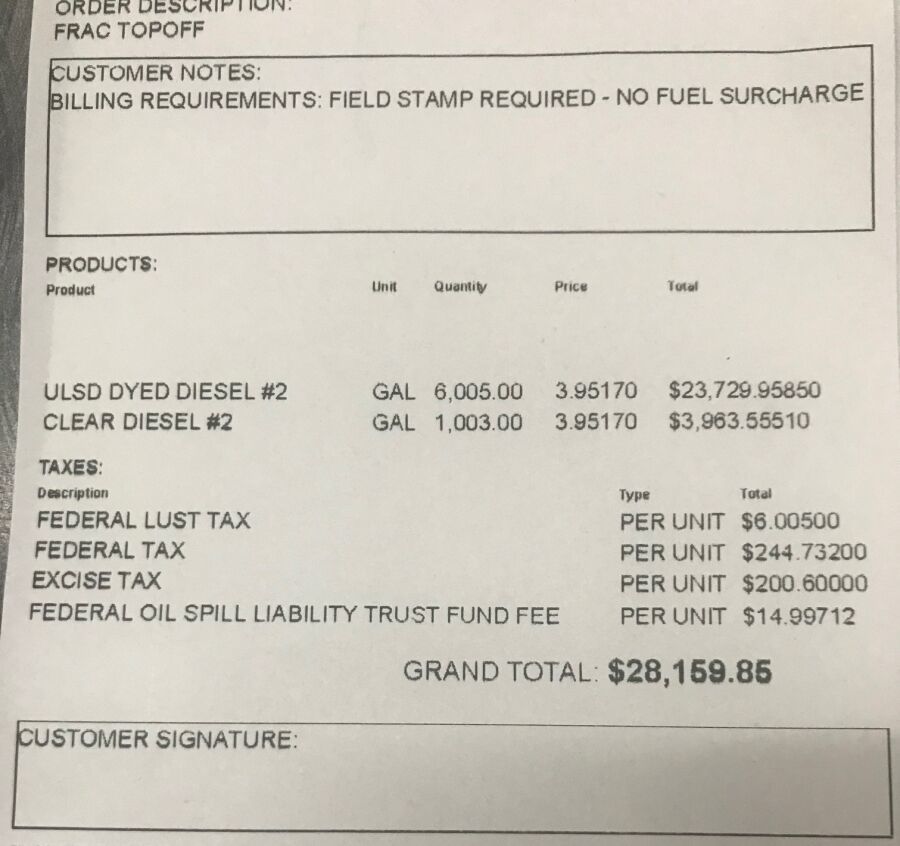

This is a photo of a ticket for fuel on the well site I am currently working on. We usually get four loads a day, so we are spending about $100k a day just for fuel. I am not sure how much it is marked up but it is the best I could come up with for the wholesale price of diesel. The dyed diesel is used in our frac pumps and is untaxed. The tax shown is on the clear diesel. We are getting this from a refinery in Big Spring, Texas which is only about 15 miles away. For comparison, the TA at Big Spring is selling diesel for $5.49 a gallon.

TT On Facebook

TT On Facebook

Posted: 1 year, 1 month ago

View Topic:

Cool new app perfect for truckers

The founder of Autio was on Shark Tank last Friday night. Not sure if it was a new episode or a re-run. He did not mention anything about AI, but did say that they had snippets about 9,000 different locations around the US recorded. He did not get a deal with any Sharks because he wanted too much for a share of the company and would not back down on it. He was probably on the show just to get the PR from being there.

My personal view of the app is that it would be a waste of money. How many times does one want to hear the same information about a place they've been through before? I'm thinking it would get old pretty quick.