Per Diem Pay Deductions

Topic 25609 | Page 1

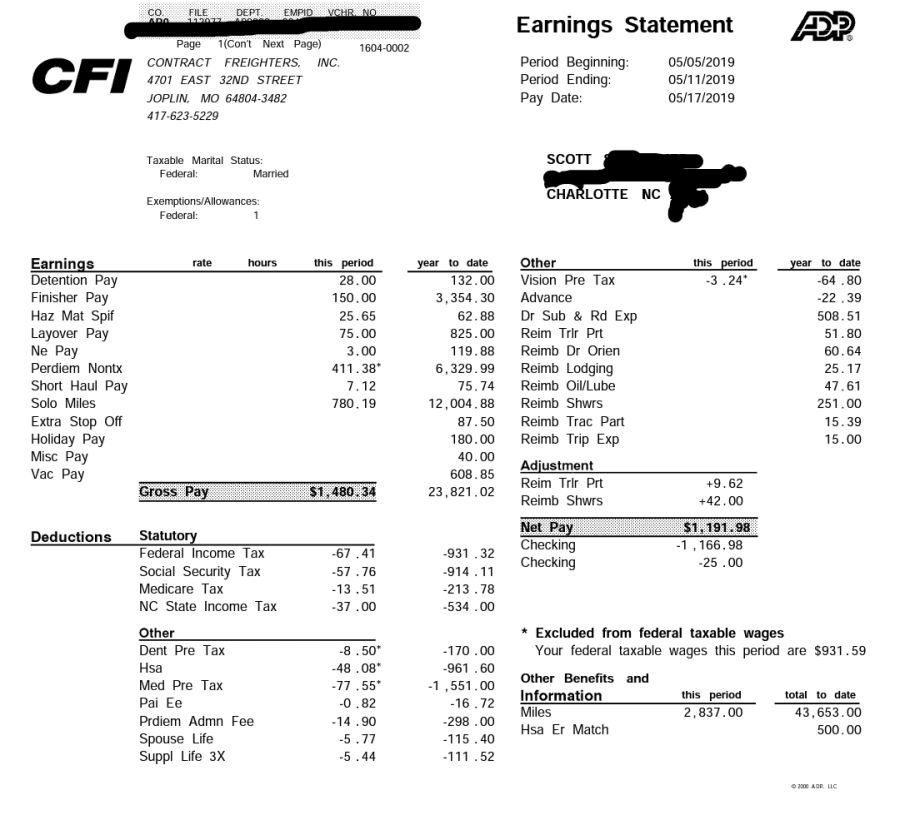

New trucker here. About 4 months now, and I noticed something a little alarming on my pay stubs. I get $66 perdium a day, and my pay stubs show it included in my gross and then 100% of it deducted in net pay. In other words, I'm not recieving any of my perdium pay. So far, I've earned over 5k perdium and my year to date deductions show that same amount. I wont be able to contact HR until Monday. In the meantime I was hoping someone can possibly confirm to me what is going on here and maybe put my mind at ease, because it really looks like there is some sort of deduction error here that makes no sense. It's my first time using this forum so I'm not sure if I can upload a screenshot of my pay stub and attach it to this message for ppl to see, but if that feature is available itll be attached so you guys can see what I mean. Thank you to anyone who can offer information. Regards ~ Tony

Per diem is non taxable. Therefore, they probably are deducting it from your taxable income. Give us an example of one weeks gross pay vs net....

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

What happens in my check that makes it kind of look like that is the company takes my per diem that week ($462), subtracts it from the gross, taxes the new gross, then adds it back to the resulting net.

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

Your paystubs may show it as gross. Your W-2 should show it as non-taxable income.

It depends on how much info is actually broken down on your paystub. Most don't show non-taxable income.

Rick

Here is how it is on my pay stubs.

Take a screen shot. Edit it. Hit the photo button above your post. Use preview button to make sure you have it right.

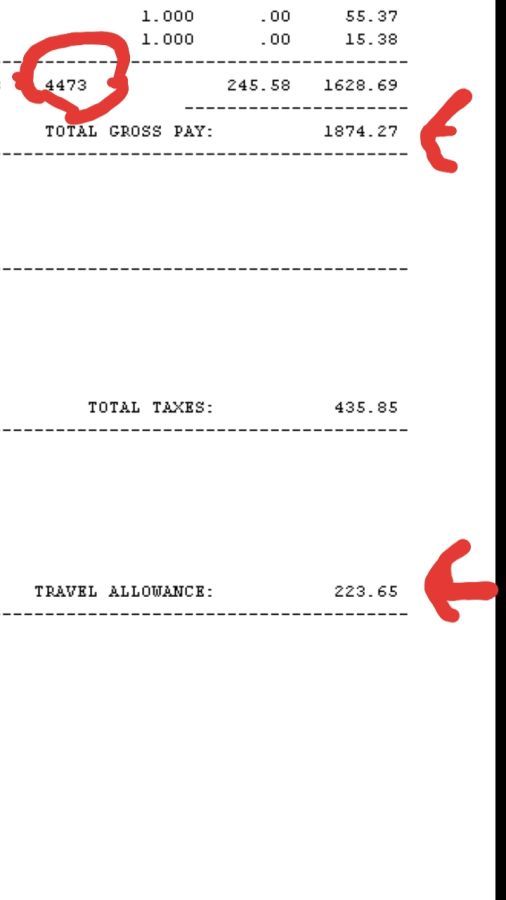

Mine seperates it. The circle is my miles. It adds a gross, then takes out the taxes, then adds the per diem as "Travel Allowance"

And yes, you can add a screen shot using the "photo" button above. Upload the pic, add a caption the hit the green button.

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

New Reply:

New! Check out our help videos for a better understanding of our forum features

Preview:

TT On Facebook

TT On Facebook

New trucker here. About 4 months now, and I noticed something a little alarming on my pay stubs. I get $66 per diem pay per day, and my pay stubs show it included in my gross and then 100% of it deducted in net pay. In other words, I'm not receiving any of my per diem pay. So far, I've earned over 5k per diem and my year to date deductions show that same amount. I won't be able to contact HR until Monday. In the meantime I was hoping someone can possibly confirm to me what is going on here and maybe put my mind at ease, because it really looks like there is some sort of deduction error here that makes no sense. It's my first time using this forum so I'm not sure if I can upload a screenshot of my pay stub and attach it to this message for ppl to see, but if that feature is available itll be attached so you guys can see what I mean. Thank you to anyone who can offer information. Regards ~ Tony

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay