Profile For Rick S.

Rick S.'s Info

-

Location:

Fort Lauderdale, FL -

Driving Status:

Company Driver In Training -

Social Link:

Rick S. On The Web -

Joined Us:

16 years, 1 month ago

Rick S.'s Bio

No Bio Information Was Filled Out. Must be a secret.

Rick S.'s Photo Gallery Group 1 of 6

Comments By Rick S.

Posted: 4 years, 5 months ago

View Topic:

Wow, thanks Rick for the in-depth response. I was Baker-Acted bit not committed, only observed for just over 48 hours. The commitment in question was a result which was associated with a Federal Criminal Charge. However, I didn't use any a diagnosis as a defense. The case didn't reach that point of decision. One felony is almost 8 years past indictment date. I did receive a DOT Physical card. I get what you say about private school but being a Veteran, there's an education grant which only covers the Self-pace school. According to DMV , your right about receiving a CDL with a commitment but it would be difficult if the commitment was within 2yrs as that's the way the question is posed at DMV. Mine is over 11 yrs about. I really appreciate your information, I assume the company I worked for before didn't mind the issues. Maybe that will still be the case.

So I assume they nolle prosequi (declined to prosecute), or was there a deal and a nolo contendere (no contest) plea and probation? Typically, federal prosecutions come with a conviction, even if you make a deal (unless you go cooperating witness - and even then, I have friends who testified and still did some time and got a conviction on their records - phone room scam stuff).

Yeah - I work both sides of the street - work for lawyers, and have friends that get caught doing shady stuff. I'm an "objective observer", so I watch, take all of it in - and learn.

Some of how companies may look at you - depends on the severity of charge (especially a the federal level) and whether or not you got a conviction out of it.

The commitment, if it was not court ordered, usually won't come up on a BG check - but you also have to be careful about lying on federal forms (like the DOT Med Form), because just when you think you're off their radar - knock knock knock.

Any company you go to - is going to do their own DOT Physical - so you are going to have to go through that again.

Out of curiosity - did you document your hospital stay for the Doc that did your physical? Or did he just say "OK" and move past that? Company ME's are likely to be a little more inquisitive, so do back yourself up with documentation.

As far as schools go - I get it - but keep in mind - going to a private school DOES NOT GUARANTEE YOU A JOB. Their job is TO GET YOU A CDL - NOT GET YOU A JOB (regardless of how well they sell you on their "placement record") - which is why we typically (ALWAYS) recommend doing COMPANY BASED TRAINING. If you get past orientation (and your medical exam), and complete training - YOU ARE ALREADY HIRED. In fact - you are hired the moment you get in the truck with your CDL Permit. So getting past the BG check, medical exam and CDL testing - means YOU'RE IN. Versus going to a private school, getting the shiny new piece of plastic - and then NOT being able to get a hire (for whatever reason).

Even with a new CDL - you STILL have to get additional training (as a "recent grad") and you pretty much have to get a HIRE somewhere. Most companies want to see "recent grads", within 30-60 days of graduation. So if you go the CDL School route - start APPLYING EVERYWHERE.

Company training is FREE - in that, you make a commitment (not that kind of commitment - sorry, couldn't help myself) to work for a period of time (usually a year, or some period of miles) to "work off" the expense of your training. Most (if not ALL) companies can also leverage veterans benefits to offset the cost of training also, so you might want to look into that also.

Again - the only thing you get from a PRIVATE CDL SCHOOL - IS A CDL. We've heard of many people that GOT their CDL's that way - and couldn't get a hire (for whatever reason). Not saying that would happen in your case - but with the "weirdness of your past" thrown in...

And - before I forget - THANKS FOR YOUR SERVICE.

Rick

Posted: 4 years, 5 months ago

View Topic:

Best companies for new drivers

I don’t like surprises but I am aware that one has to be adaptable. I love to learn and train new things. I’m also prepared for the ruff first year after spending ten and a half years in the military and twenty in law enforcement. I really look forward to reading any and all tips and advice from everyone. Thanks.

Thanks for stopping back in and updating us.

Keep us updated on your progress.

And thanks for your service...

Rick

Posted: 4 years, 6 months ago

View Topic:

I'm assuming (from TNT), that you are with Prime?

I thought they had a policy - if you have to "throw iron" - go park?

I guess there are some places you can't avoid it - "Donner Party, table for two" (old Robin Williams joke - R.I.P), or be STUCK LIKE CHUCK for the entire winter.

I know it ain't FUN - we did it in school - in nice balmy south florida - just so we could see how it was done. Not sure I would want to be out in the freezing damp - and it's just as messy (or messier) getting then of and stowed.

DO NOT ENVY YOU...

Rick

Posted: 4 years, 6 months ago

View Topic:

NOW THIS type of response is why prospective (and experienced) come to this website. Excellent!

Thanks Don - Rickipedia at your service...

Rick

Posted: 4 years, 6 months ago

View Topic:

While FMCSA regs do not prohibit someone who has been involuntarily committed to a mental institution from obtaining a CDL, or diving a CMV - you will NEVER GET A HAZMAT ENDORSEMENT. That is a disqualification for hazmat.

It may still become an issue - which could vary from company to company. An evaluation from the treating PSYCHIATRIST can go a long way towards bettering your odds. Being off meds too, also helps (so you wouldn't have to worry about possibly switching to a less-effective med that is not acceptable to a particular company (and this varies from company to company).

Are you still being treated (albeit, without meds)? Can you contact the doc who was previously treating and released you from treatment to write an evaluation and recommendation?

Is there any CRIMINAL HISTORY - ESPECIALLY associated with whatever got you committed? Was it a short-term (Baker Act here in FL) - where you get a 72 hour hold, if you are deemed a threat to yourself or others (which can happen WITHOUT COURT ORDER in many jurisdictions). Or long term (which typically must be ordered by the court)?

Having not been behind the wheel for so long - you are going to have to be RE-TRAINED. I would HIGHLY RECOMMEND AGAINST going to a private school - as you may be "spinning your wheels" (sorry), by getting a CDL and not being able to find a hire.

The BEST BET IS TO APPLY EVERYWHERE that does training in-house - that way, if you make it past Orientation and the Medical Examiner, you are pretty much assured of a hire (assuming you get through training and pass your CDL tests).

You are going to have to answer YES to questions 14 & 27 on the FMCSA DOT MEDICAL FORM, and they REQUIRE AN EXPLANATION. This is where past and present documentation from a PSYCHIATRIST comes in handy (or actually is going to be required). GO WITH THIS IN HAND - so you don't get SENT HOME TO GET IT (forewarned is FOREARMED).

It is at the DISCRETION OF WHATEVER MEDICAL EXAMINER YOU SEE - whether or not they issue a medical card. Having psych evals IN HAND will resolve any questions ON THE SPOT (pretty much).

ADA regs, when it comes to employment, leave employers open to being sued for discrimination - which is why, outside of "prohibited meds" on FMCSA regs, they WILL NOT TELL YOU AHEAD OF TIME, which meds they don't allow. Good thing you aren't on any meds - this is a plus on your side. Likewise, a clean bill of mental health from a psychIATRIST (not psychologist), should (SHOULD) preclude being turned down - BUT - (big BUT), it might happen ANYWAYS (and they will give you a reason OTHER THAN your history to preclude being sued).

All things being equal - if your criminal & driving records are clear, your diagnosis was for something that isn't (typically ) recurring, and you didn't go on a killing spree and use mental incapacity as a defense (criminal records) - you have a decent shot at a hire.

1 - DOCUMENT DOCUMENT DOCUMENT 2 - You're going to have to come in as a newbie and be trained. 3 - Don't go to a private CDL Mill - go COMPANY so you have a hire and don't blow $$ on a useless piece of plastic.

Please LET US KNOW HOW YOU DO - WHERE YOU END UP GETTING HIRED. This will help us assist other members when the question comes up in the future. This forum is a VAST REPOSITORY of user contributed information, that we use to help and advise others. Getting advice and NOT SHARING THE RESULTS DOES NOT HELP OTHERS...

Rick

Posted: 4 years, 6 months ago

View Topic:

Most states fail to measure up to safety advocate's recommendations

Karens...

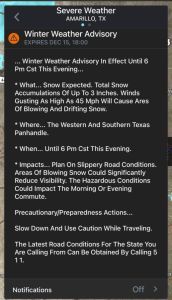

The cops have been kind of lax - to minimize contact with the public (C-19 scare). I see a lot of "equipment defects" on cars down here, that would normally be PC for a stop - but I guess they only stop people now, when they want to search (and use a license plate light for probable cause).

Here in SoFla - we only locked down for a very short time at the beginning (as far as making people stay in their homes). Thank GOD for DeSantis. Streets were empty at the beginning - we went back to our usual traffic jams pretty quick, and people got tired of being locked down pretty quick too (and started going out ANYWAYS). T'was nice for awhile.

In summary, Advocates offer the following safety recommendations, 390 of them, that states need to adopt:

For the love of sweet baby Jesus - GET A LIFE. 390 more implementations of government interference - "for our own good".

Does it NEVER END (apparently NOT)...

Rick

Posted: 4 years, 6 months ago

View Topic:

Hey everybody, Not sure if you remember me

Rick S. - As for what my Federal charges are, they are two counts of Distribution of Methamphetamine. I also have a state felony from when I was 19 ( I am 33 now so its very old) was for PWID (Possession with the intent to deliver) Marijuana. For the federal charges, the official charge date has been a little over 5 years so I do have some time away from the charge date. A lot of companies want 10 years since the charge date before I can be hired, some want 7, some want 5, others are on a case by case basis. I am open to just about any company as long as they meet what I need financially to stay afloat and also provide decent training as I don't feel I could just jump in a truck and be on my way yet. I do feel CONFIDENT in what I have already learned but I still struggle with some things such as doing really well with parallel parking and alley dock. I can do it, it just takes me a few times of pulling up and adjusting myself. The whole opposite turn for backing up still screws me up in my head during the process. I think with time I will become better at it, but I still need some more work before I just get thrown out to the wild. I am also a bit worried about routes that Include NYC unless I get some better training. I live right outside of NYC and I go there often, I don't know if I would be able to maneuver through the city quite yet. This is just anxiety talking I guess, I will do what is asked of me, I just want to do it right.

Some (most) look at the DATE OF CONVICTION - not the arrest date. Many won't take you until you are off supervision (even non-reporting) - so if you have an offer from Swift/Schneider, with them knowing your background - JUMP ON IT - like NOW.

There are only a few crimes (surprisingly) that with DQ you from getting a CDL at all:

Bribery

Smuggling

Arson

Kidnapping

Assault with intent to commit murder

Extortion

Treason

Using a commercial vehicle to commit a felony

Causing a fatality due to negligent vehicle operation.

So it's a pretty wide-open field for most felonies. Getting a HIRE is entirely another story.

Rick

Posted: 4 years, 6 months ago

View Topic:

Hey everybody, Not sure if you remember me

With your legal situation - go WHERE YOU CAN GET A HIRE (since you say many are turning you down).

Schneider and Swift are both TWO GOOD PLACES TO START OUT (and good places TO STAY, as a number of members here did).

After a year of PROVEN SAFE & PRODUCTIVE DRIVING (and a year further out from your legal issue), MORE DOORS will open for you. At year 2, more still - year 3, you can pretty much write your own ticket.

Don't recall what you were on paper for - federal charges are usually more serious than local beefs. But if they were not serious enough to prevent you from getting your CDL in the first place (disqualifying charges) - then you are in better shape than many. It might take a minute to be able to get a HM endorsement though.

PERSEVERANCE FURTHERS (or so they say). Glad you're getting things worked out. Keep us posted on your progress...

Rick

Posted: 4 years, 6 months ago

View Topic:

3 month card, now companies are walking

Now - there IS SUCH A THING as OSA. And weight is a factor - but skinny people get it too. Neck diameter is also a factor, but pencil necks get it too.

A friend had it SO BAD - he went into the hospital with pneumonia, and his heart was stopping - they put in a PACEMAKER and put him on a CPAP.

The SCAM PART comes in, because the testing criteria IS SO BOGUS, that FMCSA WON'T EVEN MAKE IT A RULE in 49CFR (so it must be bogus).

Not the part where it's a REAL AILMENT - and prevents restful sleep - but the determination to test is based on BAD SCIENCE.

So do the test (and people like Prime will send you and pay up front, as Kearsey mentioned) - and if you HAVE IT - BETTER TO BE DIAGNOSED and treated. And if you DO NOT - there you go.

It's a "catch-22" - again, based on testing criteria that is as inaccurate in diagnosis. BMI and Neck Diameter - when skinny and thin-necked people are also afflicted?

Horsepuckey.

And it's really unusual for a non-company Doc to ask for a sleep study - because the CO's usually have a "piece of the action", at the sleep center they send you to, and probably buy the CPAP's they sell you in bulk.

Please keep us posted on your progress - I am ESPECIALLY INTERESTED TO HEAR THE RESULTS OF YOUR SLEEP STUDY...

Rick

TT On Facebook

TT On Facebook

Posted: 4 years, 5 months ago

View Topic:

Mental Health Disqualifiers

Guess I'll take my sense of humor where folks can appreciate it and take a moment to chuckle at themselves.

Later....