Prime Inc. Solo Company Driver Pay 2018/w Checkstubs

Topic 23721 | Page 2

Hello everyone. I've got another batch of check stubs for every week of November. I did pretty good this month.There was a bit of a setback a few days ago.I took a wrong turn into a dead end and made a bad judgment call to avoid having to back up the curved hill i had come down. Something possessed me to try and turn around in the grass which resulted in me having to call for a pull out after the tractor sank and I had myself stuck in a muddy mess.That was a $500 lesson and I still had to spend nearly an hour afterwards backing up through the pitch black curve in the middle of the night. But I cannot complain about anything else.This month went well.I have been fortunate enough to avoid the winter weather. Don't think i'll be able to say the same over the next couple of months haha.

11/02 and 11/9 are less than normal due to hometime taken 10/30- 11/2 11/30 is less than it should have been due to the $500 pull out

Totals:

$4618.18 Net $5,527 Gross

Here is a link to a One Drive folder I will continue to add my check stubs to

https://1drv.ms/f/s!AjmUse6taMJi-EmKy_808ao0sifC

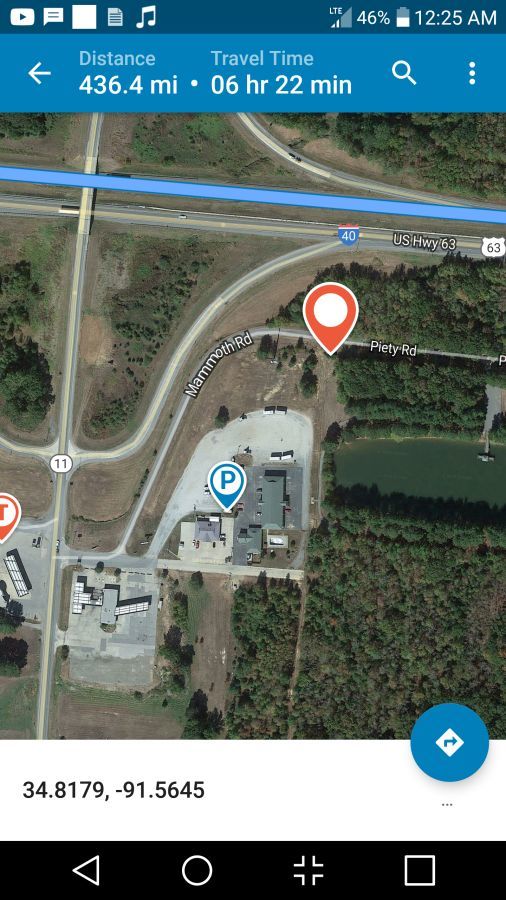

If you had kept going, it looks like there is a large parking lot just up the road. You might have been able to turn around there

If you had kept going, it looks like there is a large parking lot just up the road. You might have been able to turn around there

That's actually what I was trying to get to but endednup turning early and going into the dead end where the big red marker is.I didn't see the second turn and assumed that path looped around to the parking area.Nope.

The one thing that has always bothered me is how many of these companies do Per Diem.. This is good example.. It is stated up above that per diem is .08 cpm.. The national per diem allowed is $63 per day non taxed.. So some basic math here..

lets say you run an average of 600 miles a day for 5 days at .45 cpm.. 600x5=3000x.45=$1350 .08x3000=$240 of that is non taxable.. But same millage and days if used $63x5=$315 non taxable.. So basically the companies that offer the cpm for per diem is screwing the drivers by not giving them full $63.. And if you look at the bigger picture and say you run 50 weeks out of the year with same average, then your loosing $3,750 that should have not have ever been taxed.. Those of you who make per diem with cpm I invite you to look at your check.. Check what you made for each paid day out.. Then put against the $63 per day and see which one averages out more.. And see if your company matches up to it..

Preface: I am NOT a CPA or Attorney.

I think we all need to take a harder look at the Per Diem issue. As I understand it, the new tax law ("tax cut") eliminates the per Diem deduction for individuals. That would mean that O/O and anyone else who files a Schedule C (as a business) can claim the $63/day (actual only 80% of it) but company drivers who file as individuals (not businesses) can NOT. Therefore, company-offered per Diem may be the only way for company drivers to get the tax advantage from per Diem deductions.

Here's a quote from this (https://www.freightwaves.com/news/2018/1/16/ending-the-confusion-over-per-diem) website: "According to Rutherford, owner-operators (and leased drivers) will be able to continue using the per diem and deducting it on their taxes through Schedule C or on their corporate return. For a driver on the road 250 days a year, that’s $15,750 of potential deductions. Combined with other business expense deductions, and the new 20% deduction on pass-through corporations (if your business is structured this way), there are still plenty of tax benefits.

For company drivers, though, the situation is a bit cloudier. They have lost that $63 deduction, but individual (or married) tax filers receive the larger standard deductions ($12,000 for individuals, $24,000 for married filing jointly) now available. Will those deductions be enough to offset the loss of the per diem? That depends on the individual tax situation of each driver."

Also, Schneider has a detailed post that explains per Diem: https://schneiderjobs.com/blog/driver/2018-truck-driver-per-diem-pay

The one thing that has always bothered me is how many of these companies do Per Diem.. This is good example.. It is stated up above that per diem is .08 cpm.. The national per diem allowed is $63 per day non taxed.. So some basic math here..

lets say you run an average of 600 miles a day for 5 days at .45 cpm.. 600x5=3000x.45=$1350 .08x3000=$240 of that is non taxable.. But same millage and days if used $63x5=$315 non taxable.. So basically the companies that offer the cpm for per diem is screwing the drivers by not giving them full $63.. And if you look at the bigger picture and say you run 50 weeks out of the year with same average, then your loosing $3,750 that should have not have ever been taxed.. Those of you who make per diem with cpm I invite you to look at your check.. Check what you made for each paid day out.. Then put against the $63 per day and see which one averages out more.. And see if your company matches up to it..

CPM:

Cents Per Mile

Drivers are often paid by the mile and it's given in cents per mile, or cpm.

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

HOS:

Hours Of Service

HOS refers to the logbook hours of service regulations.OOS:

When a violation by either a driver or company is confirmed, an out-of-service order removes either the driver or the vehicle from the roadway until the violation is corrected.

New Reply:

New! Check out our help videos for a better understanding of our forum features

Preview:

TT On Facebook

TT On Facebook

And if you are close to retirement, or have so so credit, per diem actually hurts you

CPM:

Cents Per Mile

Drivers are often paid by the mile and it's given in cents per mile, or cpm.

Per Diem:

Getting paid per diem means getting a portion of your salary paid to you without taxes taken out. It's technically classified as a meal and expense reimbursement.

Truck drivers and others who travel for a living get large tax deductions for meal expenses. The Government set up per diem pay as a way to reimburse some of the taxes you pay with each paycheck instead of making you wait until tax filing season.

Getting per diem pay means a driver will get a larger paycheck each week but a smaller tax return at tax time.

We have a ton of information on our wiki page on per diem pay

HOS:

Hours Of Service

HOS refers to the logbook hours of service regulations.OOS:

When a violation by either a driver or company is confirmed, an out-of-service order removes either the driver or the vehicle from the roadway until the violation is corrected.