Comments By Bush Country

- Bush Country

- Joined:

- 9 years, 4 months ago

- Comments:

- 75

Posted: 2 years, 5 months ago

View Topic:

What is the deal with 1099 trucking jobs? Is there a catch?

I work as a 1099 contractor (consultant) in the oilfield. The tax implications discussed below should be similar for any business.

As to how this applies to trucking – for 1099 to be worthwhile I think one would have to be paid at a considerably higher rate (I’m thinking 2x to 3x higher) than a company driver. That doesn’t take into consideration the other issues involved as pointed out by Old School, Delco Dave, PackRat, and Zen joker.

I bill the oil companies through a consulting company that takes 10% of my day rate and provides liability insurance and workman’s comp, as well as paying me the same week that I invoice instead of me having to wait for the oil company to pay. Since my wife is employed, we have health, dental, and vision insurance through her employer. If I needed to get my own health insurance the BCBS plans available through the consulting firm range from $900 to $1,550 per month for me only. Those are the rates for age 64+. For a 21 year old the rates are from $300 to $500 per month and increase based on age.

For me, there were three ways to set up a business as a contractor: sole proprietor, LLC, and S-Corporation. Each one has its own tax implications. When I first started I ran as a sole proprietor for a few months before getting my S corp set up.

A sole proprietor is responsible for the Self-Employment tax (Social Security), Medicare, and income tax on every penny earned. SS tax is 12.4% and Medicare is 2.9%. Income tax can be estimated based on what one expects to earn. So for starters, there’s 15.3% of gross taxed, not counting income tax. I live in Texas, so there’s no state income tax to consider.

I have not operated as an LLC, but my understanding is that any money earned by the LLC becomes taxable once it is withdrawn from the LLC, and is fully taxed like the sole proprietor example.

I operate as an S-Corporation. I have to pay myself a “reasonable” salary. Technically half of the SS tax is withheld from my salary and the other half paid by the S corp. Same for Medicare tax. I withhold 20% for income tax. The SS, Medicare, and income tax are paid monthly via form 941. I also pay a quarterly payment since my wife and I have other income from investments. My main expenses are vehicle expenses (gas, tires, oil changes, repairs) and FR clothing, all of which I pay for through the S corp. I also pay unemployment insurance. In 2022, mine was $0 for the state of Texas, and $42 to the feds since I’ve not filed any unemployment claims on myself.

The tax advantage of an S corp is that anything left over after my salary, taxes, and expenses are paid can be taken as a “distribution”, and is not taxed (by the Feds, states probably vary, but -0- for Texas). For 2022, as percentages:

Total 1099 gross receipts = 100% paid out as follows: Salary = 37%, Taxes = 11%, 401k match = 8%, Expenses = 2%, and Distributions = 42%.

The taxes were 30% of my salary.

Posted: 2 years, 6 months ago

View Topic:

Sorry this happened BK.

For newcomers reading this...

This has become a tricky little area for CDL drivers. Each time you get a new physical done you must self certify it with your state. I have found the two best ways in my state (TX), are to walk it into a DMV office and have them scan it into their system while I'm standing there with the clerk, or email it to the specific email address the state provides. I always follow up the email one week later with a phone call, verifying the new expiration date.

I never trust the state to handle important documents efficiently. I do take measures to hold them accountable.

OS - I scanned & emailed mine in Texas last year (5.24.22) and received an automated confirmation email back the same day. In the email there was a link to use to check eligibility which is still active today (1.5.23). Seems as though the system works well, based on a sample size of one.

Posted: 2 years, 7 months ago

View Topic:

Travis - you've started for SLB? Now you've joined me in the ranks of oilfield trash. How's it going?

Posted: 2 years, 8 months ago

View Topic:

Schlumberger Oilfield Concrete Driving

Travis -

Where is the job located?

Schlumberger, or as they are changing the name, “SLB” is the world’s largest oilfield service company. I’ve not worked for them, but I have worked for other service companies and been in the business for over 40 years.

The advantages I see for the job for a driver are – hourly pay, time off, and full benefits (health, dental, & vision insurance, 401k, etc). There’s also room for promotion – normally a bulk truck driver would move up to cement pump operator, and from that to cementer (service supervisor). For housing, they will probably put you up in a man camp – I’d ask about that to be sure. I’m surprised that SLB is paying for flights for operators, so get that in writing. You will travel on your time, which makes that 6 days off more like 4 depending on your travel schedule.

The hours for your two weeks on duty are long. You will be out in the weather no matter what it is. I work on the frac side, and the only thing we shut down for is lightning since we have so much electronic equipment on location. You will also eventually work every day of the year. Drilling rigs, which you will be delivering to, generally don’t shut down for holidays.

Other companies that should have positions like this are Halliburton, BJ Services, and Nextier. Plus there’s some smaller companies, but I’m not sure which of them are in the cementing side.

There are other driving jobs. Hauling frac sand, fuel delivery, rig moving (specialized trucks for this), hauling drill pipe & casing, and so on. I don’t recommend hauling sand – it’s done by a lot of small companies as third-party contractors, and I suspect that a lot of them are 1099 companies. Fuel delivery, on the other hand, I’ve had every driver I’ve asked say that it is the best driving job they’ve had.

Not to be pedantic, but it is cement, not concrete. Concrete has aggregate in it and is used in construction. Cement is what holds the aggregate together. Oil field cementing does not use aggregate.

Hopes this helps!

Posted: 3 years ago

View Topic:

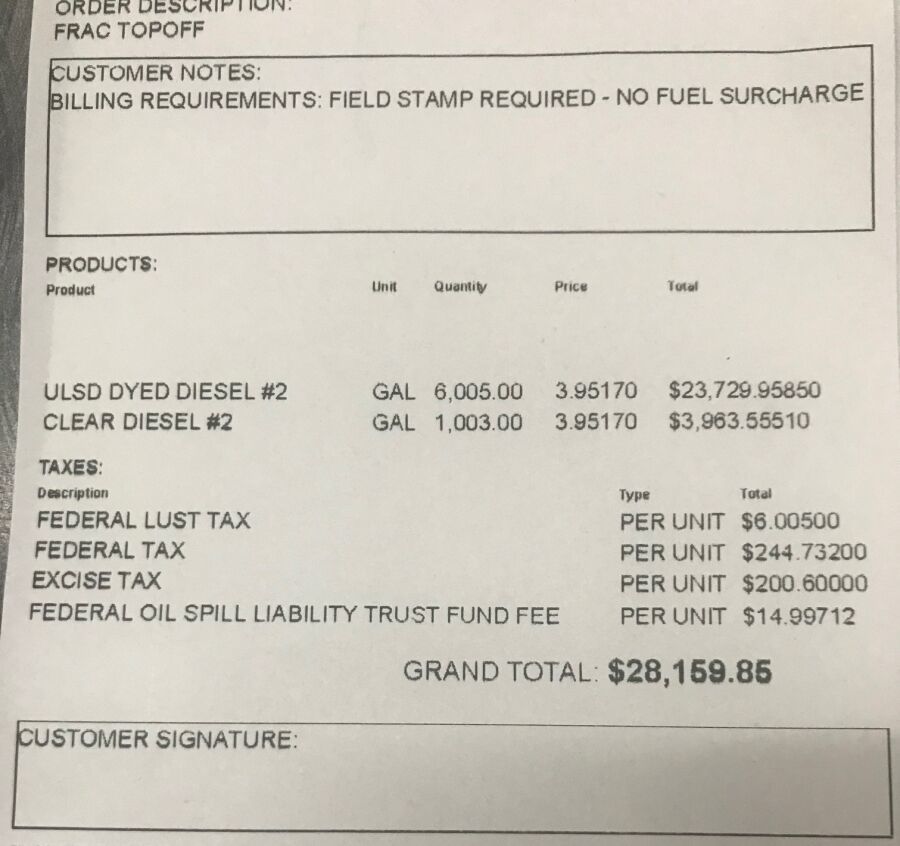

This is a photo of a ticket for fuel on the well site I am currently working on. We usually get four loads a day, so we are spending about $100k a day just for fuel. I am not sure how much it is marked up but it is the best I could come up with for the wholesale price of diesel. The dyed diesel is used in our frac pumps and is untaxed. The tax shown is on the clear diesel. We are getting this from a refinery in Big Spring, Texas which is only about 15 miles away. For comparison, the TA at Big Spring is selling diesel for $5.49 a gallon.

Posted: 3 years ago

View Topic:

Me: " For instance, the S&P 500 has averaged a 10.67% return from 1957 to the end of 2021. That is the 50 year average. "

Dang it. That's 64 years, not 50. I need an embarrassed emoji.

For the record, the S&P 500 actually has 505 stocks in it. The index that became the 500 originally started in 1926 with 90 stocks, and has also returned an average of a little over 10% since then.

Posted: 3 years ago

View Topic:

Bush Country I appreciate it like I was saying to read the Mustache King cause I'd do a bad bad job of explaining those. if its alright I'd like to run my whole understanding by you though to make sure I've got it square since after all it's about my future. lol

Interest is the wrong term I see that now but the logic behind it was that since me and him are both youngins we could reasonably figure the return on investment would be closer to 10% since we're talking about the stock market as a whole over a few decades, that's why I say average cause its just an example for talking general. now what I mean by interest even if it's not the right term is just the pay off, twenty years down the road with the example numbers I'm giving at 10% you could start taking out the dividend the index fund pays towards that $64k each year and the rest of it set to automatically withdraw into your account, there would be less shares cause you sold some but over a few years the amount the rest will grow back could keep resetting you back to where you were when you started taking money back out. yeah this will all depend on what the stock market is doing at that time but give it a few years and it tends to keep going back up, also why you wanna set an amount higher than what you will live on and also why you take from the index funds before touching the 401k. sorry if I cant explain it better than that but that's kinda the way it goes if I was reading him right? thanks man

Danny K., to be clear, your thought process is correct. I chimed in to hopefully provide some clarity in terminology and the difference in earning interest and market returns. For the sake of discussion, you can use interest = return on investments. As long as you understand the underlying difference – that you are not going to get that 10% every year.

To give a personal example, I calculate my net worth at the end of every quarter. Our investments fell 18.84% between December 31, 2019 and March 31, 2020. That was when Covid hit. It has since come back, although I’m not looking forward to the calculation that I’ll do two days from now.

The point being you have to make allowances for things like that. As you said “yeah this will all depend on what the stock market is doing at that time but give it a few years and it tends to keep going back up”. That is spot on. It’s also the reason you cannot automatically withdraw 10% every year. Because there are some years in there that the market is going to be down over 30%. You can count on it. After significant drops, the market usually comes back fairly quickly. But there have been times that it took six or seven years to get back to where it was previously. The general rule of thumb is the “4% Rule”. This says that, over the course of a 35-year retirement, you should be able to withdraw 4% from your investments and never run out of money. Do a web search for that for a more in-depth explanation.

Here's the link to where I got my information on historic returns:

https://www.investopedia.com/ask/answers/042415/what-average-annual-return-sp-500.asp

Posted: 3 years ago

View Topic:

Thanks Bush Country - that was well said!

Some of the comments about "interest" were misleading and confusing.

Thank you OS.

Just trying to contribute to the "educate" part of this web site. I may not have much to say about trucking, but I've been investing for almost 40 years. Believe it or not, that response was edited for brevity!

Posted: 3 years ago

View Topic:

The best advice I can give is to be a Mustachian.

see there's this guy Mr. Money Mustache who does a bunch of free advice on his blog about early retirement. the jist of it all is you get yourself in the habit of spending less then you make and you start putting a chunk of that extra money in index funds. I'd do a crappy job of explaining those but search for what he has to say about it. one of the safest ways to invest over the longterm and get good returns and if you start now when you're this young you'll be sitting pretty down the road. I'm putting 10k in at the end of my first year and plan on doing that again each year, maybe 20k if I can start to swing it. so now if your averaging 10% return on investment per year which is how the index funds go and I keep on putting 10k in each year, in 20 years that's $430,000 interest earned. now at that point you got $640k total and if you stop putting money in then you still average $64k interest each year, that's most people's whole salary, but it's free money each year, sacrifices in the short term pay off big in the long run.

I've read some of Mr. Money Mustache as well as some others in the FIRE movement. I also follow the Minimalists. I agree with them both and, in my opinion, people would be much better off financially and emotionally if they could learn to distinguish the difference between wants and needs.

I'm in complete agreement with your method of consistent investing, and index funds are the best way to go for people that don't have the time or interest in spending a lot of effort on investment education & research.

There is a difference between interest earned and average rate of return in the stock market. The statement above, "....you still average $64k interest each year..." is incorrect. It is an average investment return, not interest paid, and to realize that money, one would have to sell part of the asset (index mutual fund).

An investor earns interest on interest bearing cash deposits, like a savings account or certificates of deposit. The initial deposit (principal) is essentially not at risk, and once the interest is paid, it doesn't go away either.

One is NOT earning interest if invested in a stock market index fund. Both the initial investment and any reinvested returns are constantly at risk in the market. For instance, the S&P 500 has averaged a 10.67% return from 1957 to the end of 2021. That is the 50 year average. Between October 2007 and March 2009, the S&P 500, and thus, an S&P 500 Index Fund, fell by 46%. So a $500,000 account in October '07 was worth about $270,000 by March '09. But then a 10 year bull run started and if one had $500,000 in the fund at that point, by the end of 2019 it would have been worth around $1,250,000! The S&P took a 20% hit in 2020 with the C-19 panic ($500k became $400k !).

Mutual funds, whether indexed to something like the S&P 500, or not, lessen an investor's risk. Investing in individual stocks can yield both better returns, as well as higher losses. I've had stocks I made a lot of money on. I've also had stocks that I lost my entire investment!

TT On Facebook

TT On Facebook

Posted: 2 years, 4 months ago

View Topic:

I may have to make a choice.....

NaeNae,

My mom passed away from dementia in 2021 at age 92. I got the call from hospice that she was "actively passing" as I was driving home from Knight's Top Gun in Phoenix. This was on a Friday. They said she had been actively passing since that Monday. I asked them how long she had and they said less than 72 hours. I got home Saturday morning and went to see her that afternoon. I planned to go back on Sunday afternoon and got the call that she had passed about 30 minutes before I was going to go see her.

The point of this story is that if your mom is in hospice care, they should be able to tell the difference between her general decline and actively passing. If you wanted to stay on the road but make it to her before the end ask hospice about this and request that they call you as soon as she is actively passing, and ask for a time frame.

As for if you "should" be there - only you can answer that, and you have to answer to no one for your decision.